World economy

The MSCI World index has fallen for the past three consecutive quarters, which has not happened since the financial crisis of 2007/2008. Measured in EUR, the global stock index has fallen by 13% and the European bond index by 16% since January 1st. Bank of America estimates that $46 trillion in market value has been wiped out year to date. These movements are a result of the deteriorating outlook. We address inflation, interest rate policy and expected economic growth in Europe and the US and briefly discuss the economic issues in China.

First Europe. The most recent increase of the consumer price index in our country was an impressive 17.1%, mainly driven by the very high gas and electricity prices. Core inflation, that is excluding the more volatile food and energy prices, was significantly lower, but still high at 6.5%. For the entire Eurozone these values were lower than in the Netherlands, but still at historically high levels of 10% and 4.8% respectively. With the continued increase in gas prices, there is no prospect of a base effect taking place which could significantly depress the inflation statistic in the near term. Energy price caps can have a strong effect, but not every European country has the budgetary scope to announce large stimulus packages. This can lead to further divergence between the different countries in the same currency union.

High energy prices also make Europe less competitive/profitable internationally, especially in energy-intensive industries such as chemicals, steel and cement. Smaller companies such as bakers also see their margins evaporate on energy costs.

The ECB implemented the first rate hikes and announced further potential increases in the near future. But while the ECB is trying to soften demand with tightening monetary policy, many European politicians are calling for purchasing power to be restored.

The combination of high inflation, a challenging consumer-spending outlook and higher interest costs makes it unlikely for Europe to grow in real terms, but it is likely that nominal growth rates will still be high.

Second the US. Inflation statistics have been high for some time and have had a greater effect on core inflation. At 6.5%, core inflation is higher than in Europe. The FED recently tightened monetary policy sharply by raising interest rates. At the end of August, President Powell dashed hopes of rapid policy easing by saying that higher unemployment and negative growth are a necessary evil to restore price stability. It is likely that the policy will be tightened further. Here too, the above factors are weighing on growth expectations. For now, the consensus is that the economy will continue to grow.

Third China. After many years of high economic growth and significant contribution to global growth the Chinese economy is burdened by strict COVID policies, a crashing real estate market and high debt levels. As a result, China struggles to function as a motor for the global economy.

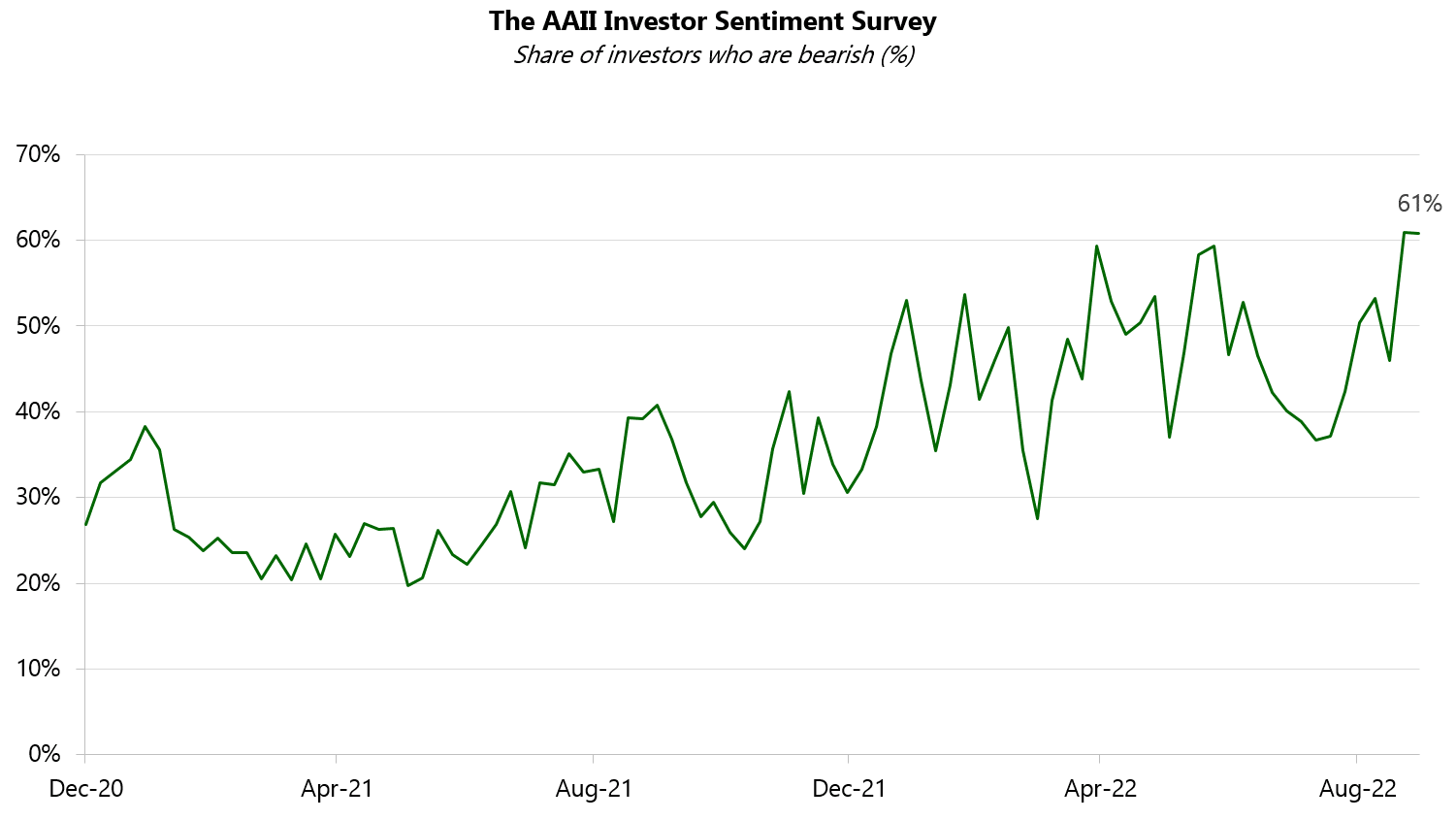

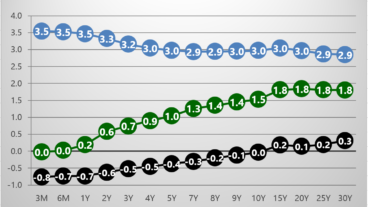

Finally, this all does not bode well for financial markets. The downturn may or may not have ended yet, but there are positive aspects to mention. First, after the recent hikes, interest on 5-year risk-free bonds in Euro is now around 2%. That is a reasonable compensation, not for current inflation, but for longer-term inflation expectations. Secondly, excessive valuations (such as for SPACs, cryptocurrencies and unprofitable companies, all mentioned in previous versions of this writing) have dropped significantly and stock valuations are once again relevant. Thirdly, a number of companies in the portfolio are attractively valued given their growth potential. Finally, investor sentiment is currently very negative. The AAII US investor Bearish indicator, which measures how negative US retail investors are, hasn’t been this gloomy since 1985, and the JPMorgan global equity sentiment indicator is equally low.

The movements in currency markets this year are noteworthy. In particular, the US Dollar appreciated c. 15% against the Euro since the start of 2022. This makes the currency relatively expensive compared to other currencies. We nevertheless maintain a higher allocation to the United States and the US Dollar, because we believe we can benefit from the safe-haven role of the currency in the coming period. We expect higher economic growth prospects for the US economy, further potential interest rate hikes and see a better investment universe in the US with more quality companies that fit our selection criteria.

Bonds and liquidities

With a relatively low interest rate sensitivity, the bond portfolio is able to withstand interest rate increases with limited losses. The combination of higher interest rates and increased spreads results in a significantly higher yield on corporate bonds. Short-term bonds from solid debtors are being evaluated as potential additions to the portfolios.

Equities

In recent months, the allocation to companies that rely heavily on discretionary consumer spending has been reduced by selling/downsizing positions in Apple and Nike in favour of less cyclical companies such as Broadridge and Rentokil.

We keep the allocation to equities at a neutral level, with an emphasis on quality companies with pricing power and relatively low cyclical sensitivity. Should the global economy be hit by a severe downturn, this will also have a major effect on the Laaken portfolios. So far, corporate profits have not fallen and expectations are still good, but challenging economic factors could lead to earnings declines. With the generally healthy balance sheets of companies in our portfolio, we believe that these investments have enough resilience to weather this period and perform well over the long term.

The gold position has increased in relative terms due to market movements, this higher allocation is maintained.