July 11, 2023

"Inflation is like toothpaste. Once it’s out, you can hardly get it back in again"

- Dr Karl Otto Pöhl, in 1980 (German economist and president of the Bundesbank from 1980 until 1991)World economy

“The successful implementation of vaccination programs and the gradual reopening of economies have boosted confidence and lead to higher consumer spending. Currently, interest rates in Europe are at historically low levels, but central banks have begun discussions about gradual rate hikes in response to inflationary pressures.”

This is a selection from the investment outlook generated by ChatGPT with input “a one page investment outlook for 2023 and 2024”. A well written piece, but relevant only for about two years ago. For the time being, Laaken will continue to write the outlook by itself. We discuss monetary policy, inflation, equity valuation and growth prospects.

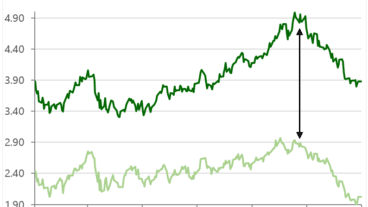

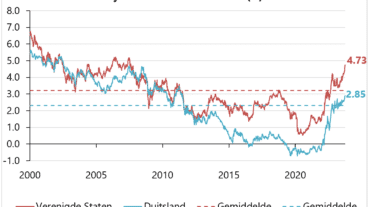

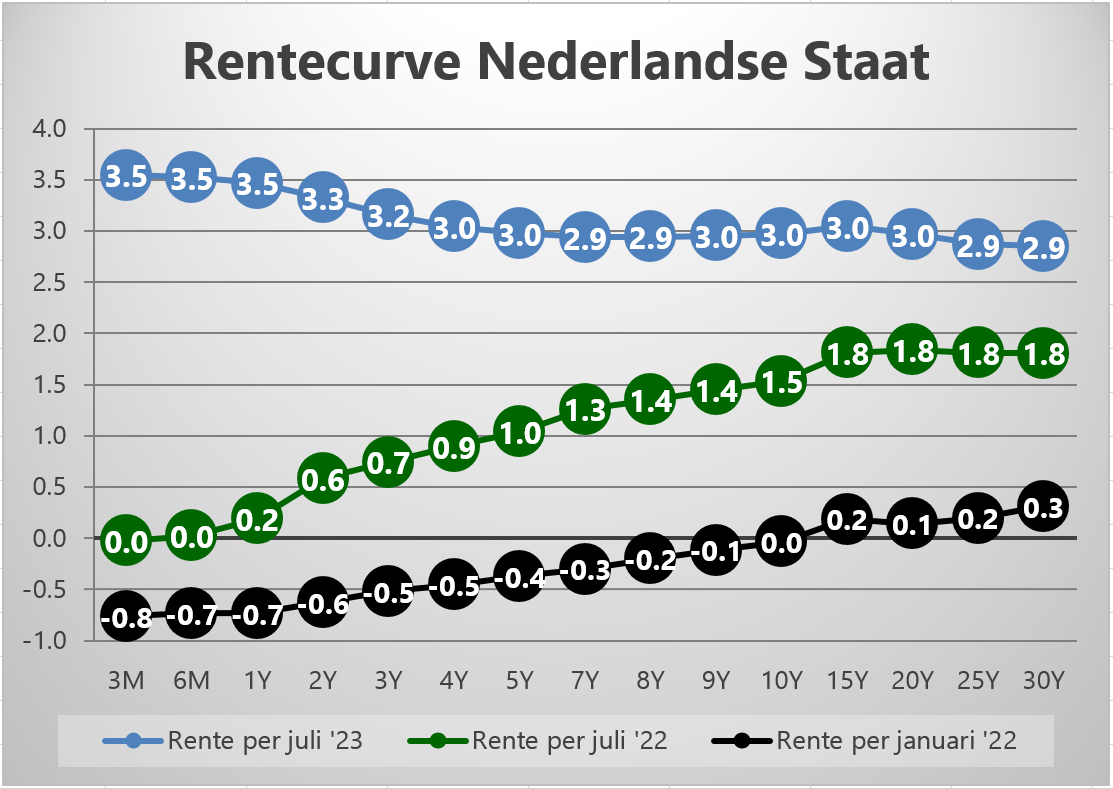

Monetary policy remains tighter for longer than initially expected by the market. Consensus expects the policy rate to fall for the first time within 6 and 12 months. The US central bank’s key interest rate is now 5.25% and the ECB’s 4.0%. 10-year government bonds in the US offer a yield of 4.0% versus 2.9% in the Netherlands. The yield curve remains inverted, with long-term interest rates lower than short-term interest rates. This also anticipates a fall in the key interest rate in the near future.

The policy rate will only fall once the desired 2% inflation is in sight. Due to lower energy and food prices, inflation is now lower than at the end of 2022, but is still 4.0% in the US and 5.5% in the Eurozone. Core inflation (excluding energy and food) is declining in the US, but is still at 3.8%. It is also falling slightly in Europe, but is still at almost the highest level since the introduction of the euro: 5.5%. Continued wage inflation remains plausible with the current low unemployment rate. We therefore remain more cautious than the market in our expectation of containing inflation and the subsequent fall in interest rates.

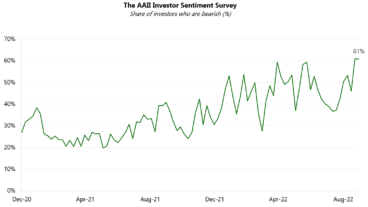

Higher interest rates should make investors more critical of valuations. Currently, one earns a risk-free return of ~5% in the US, which would equate to a P/E ratio of 20 times. Due to the recent strong performance of equities, this multiple is now often above 20. If corporate earnings do not grow, this would mean that the effective return on risk-free investments is higher, at first sight an unattractive proposition. Naturally, corporate profits are expected to grow.

Positive earnings growth prospects therefore remain important for equity performance. Supported by high inflation, nominal growth is robust (6% to 8% in Europe and the US) and companies with pricing power can continue to benefit. Earnings growth expectations and purchasing manager indices (PMIs), especially for the services sector, remain positive.

There is a big difference between growth in the services sector and the manufacturing sector. During Covid, the consumption of products has risen sharply (due to the restriction of many services during the lock downs). Now we see the reverse with a strong rebound from the services sector. Current low unemployment and wage inflation ensure that consumption of services can continue to grow. Laaken’s stock selection is well positioned for this trend.

In addition to the strong growth of the services sector, 2023 has started with unprecedented valuation increases of AI-related companies. Partly because of this, technology is by far the best performing sector in the first half of the year. In the portfolios we benefit from this development through positions in ASML, Alphabet and Microsoft. The potential of AI is undoubtedly great, but the effect on profitability for most companies is currently difficult to estimate. AI offers many opportunities, but as you would expect from us, we also continue to take a critical look at underlying valuations.

Fixed income

Over the first half of the year, the interest rate sensitivity of the portfolio was increased by adding more and longer bonds. The investment committee is reluctant to take bigger steps because inflation and the resulting tightening policy may take longer than is currently taken into account. The additional return achieved on corporate bonds is at a historically attractive level, which is why we increased corporate bonds exposure.

Equities

The allocation to equities, despite realizing gains on a number of positions, has remained at a neutral level due to the rise in the asset class as a whole. In addition, positions whose valuations had risen sharply were exchanged for equities with lower valuations. The investment committee maintains the expectation that the companies in the portfolio should be able to implement price increases and protect their margins. In the long term, this should provide good protection against inflation despite the increased valuation compared to the beginning of the year.