October 6, 2023

"Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair."

- Sam Ewing (1920-2001) American writer and humoristWorld economy

If the second quarter was characterized by “Artificial Intelligence”, the third quarter was characterized by: “Obesity”. The implications of Novo Nordisk’s new obesity drug, WeGovy, swept through the medical sector like a whirlwind. WeGovy exceeded expectations and single-handedly saved Denmark from having a recession. In the third quarter, this drug was mentioned a total of 985 times by various companies on quarterly calls, but of course more happened on the financial markets. We discuss monetary policy, inflation and business prospects.

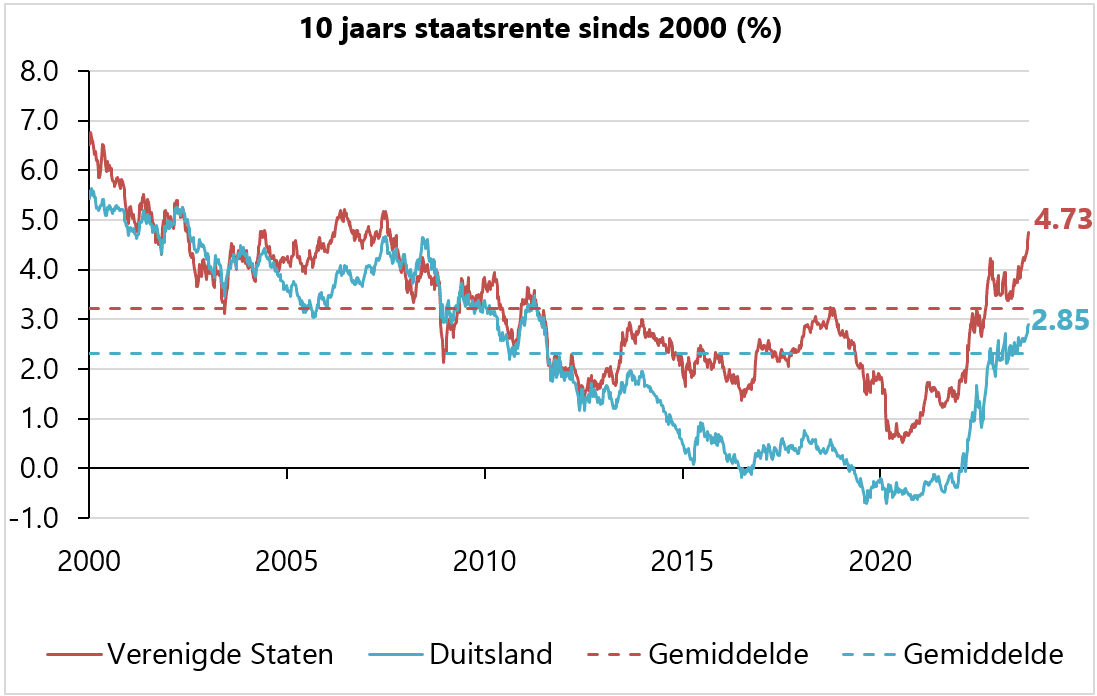

The central banks continue to raise policy rates. The policy interest rate is now 4% in Europe and 5.5% in the US. Central banks point to inflation that is currently too high and continue to implement tightening measures. The total M2 money in circulation (current and non-cash money, savings and short-term deposits) in the EU and US has fallen for the first time since the data became available, respectively 1981 and 1960. Short-term interest rates remain higher than the long-term interest rate, hence the market anticipates interest rates to fall.

Initially, the first decrease in interest rates was expected halfway through this calendar year. The financial markets now expect a first decrease in interest rates in the first half of 2024. We deviate from this and still take into account a “Higher for longer” scenario in which interest rates remain high for longer than what the market is currently taking into account.

In Europe, both the broad definition of inflation and core inflation (excluding energy and food) stood at 5.3%, significantly higher than the maximum 2% ECB target. In the US, price increases are slowing down with inflation of 3.7% and core inflation of 4.3%. Falling energy prices have depressed inflation statistics over the past six months, but the investment committee expects inflation to remain high for the time being due to the following developments. First, energy and food prices normalized already in the second half of 2022 and this price dampening factor is now running out of the year-on-year inflation comparison. Second, low unemployment and strong wage growth continue. Third, the deflationary effects of outsourcing to low-wage countries weaken. Companies such as Nike, for example, have already transferred a majority of production to low-wage countries. In addition, more and more countries are expressing the wish to gradually attract manufacturing to their own country. For example, both the EU and the US have a CHIPS Act to facilitate the production of chips. Finally, the energy transition is inflationary. In addition to the current energy infrastructure, new installations must often be constructed. The International Renewable Energy Agency estimates that governments worldwide will spend $1.3 trillion on the energy transition by 2022. This annual expenditure must increase to more than $5 trillion to limit global warming to 1.5 degrees. These estimates are gradually adjusted upwards.

Many investors find a US 10-year Treasury yield of 4.7% historically attractive. However, we note that this is only the case if we look back to 2009. Before central banks eased monetary policy in response to the 2007/2008 financial crisis, the same interest rate was 5-6%.

The increased interest rates have only put limited pressure on the stock market this year. The MSCI World Index is 12% higher. The S&P 500 Index has even risen 15% in euros and is therefore a lot more expensive, especially relative to the increased interest rates. However, this does not take into account that the price increase is mainly driven by seven large technology companies, Nvidia in particular. These big tech companies have exceeded earnings expectations so far and the same group was also part of the big losers of 2022. The other S&P 493 are at a comparable level in terms of valuation as a year ago. Companies in the Laaken portfolios have positive earnings growth expectations for the coming months. We maintain our focus on valuations. A great company does not always translate into a great investment.

Fixed income

The investment committee remains reluctant to take major steps in longer duration bonds. It is taken into account that inflation and thus tightening policy may last longer. However, the historically high spreads on corporate bonds offers opportunities to lock in high returns in this segment for a longer period of time.

Equities

The allocation to equities remains neutral. Last year we wrote about the preference for companies with pricing power and acceptable valuations, in order to weather higher inflation. This year, this overarching strategy has worked out well. Companies with strong competitive positions and reasonable valuations such as Alphabet, Rentokil, Novo Nordisk and Broadridge perform significantly better. We also see the consequences for companies with weaker competitive positions. For example, investments in Dollar Stores and Richemont were evaluated, but these did not pass Laaken’s quality or valuation criteria.

Laaken prefers companies that have proven themselves over a longer period of time, in good and difficult times. Innovation is also taking place within these more established companies. This does not require turning to fast-growing companies with very high price/earnings ratios. A good example of a profit-generating company, at an acceptable valuation, that successfully innovates is the earlier mentioned Novo Nordisk, founded in 1923 and which has been in the Laaken portfolio since 2011. We highlight another Laaken holding with a good valuation, excellent competitive position and built-in protection against inflation this quarter: VISA