Investment Theses

Comfort Systems

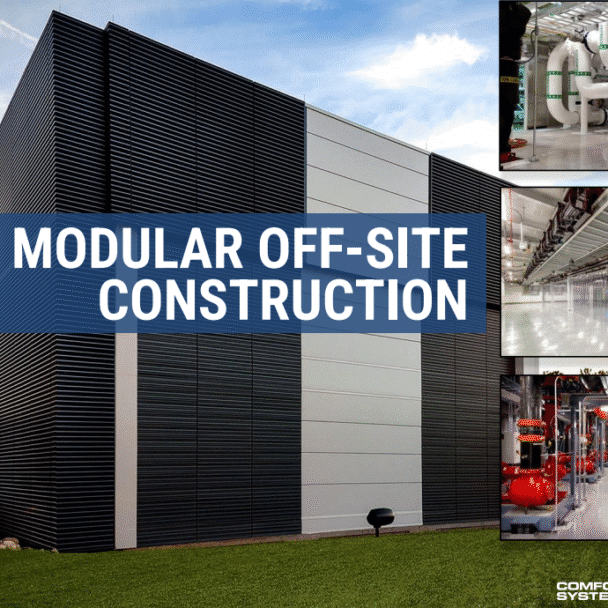

Begin oktober voegden we Comfort Systems (FIX) toe aan onze portefeuilles. Het bedrijf speelt een cruciale rol in de opkomst van kunstmatige intelligentie én de beoogde herindustrialisatie van Amerika. Dankzij een uniek consolidatiemodel en diepgaande expertise in kritieke infrastructuur, evolueert FIX naar dé blue-chip aannemer voor de digitale en industriële economie. Deze thesis verklaart waarom we geloven in de lange termijn waarde-creatie van deze positie.

Broadcom

Begin 2025 voegden we Broadcom toe aan onze portefeuilles. Hoewel het bedrijf minder media-aandacht krijgt dan Nvidia, speelt het een sleutelrol in de opkomst van kunstmatige intelligentie. Dankzij een unieke combinatie van software-inkomsten en geavanceerde chips, groeit Broadcom uit tot een AI- en infrastructuurkampioen. In deze investment thesis leggen we uit waarom we geloven in de langetermijnwaarde van deze positie.

Make Europe Great Again

Alimentation Couche-Tard

Alimentation Couche-Tard (ATD) is ‘s werelds op één na grootste exploitant van “convenience” winkels, met bijna 17.000 winkels wereldwijd, waaronder alle TotalEnergies-verkooppunten in Nederland. Hoewel de verkoop van brandstof, dranken en snacks niet zo spannend klinkt als AI, zijn convenience winkelketens een van de grootste succesverhalen op de aandelenmarkten.

TD SYNNEX

TD SYNNEX (SNX) is de nieuwste aandelentoevoeging aan de Laaken portefeuilles. Als ’s werelds grootste IT-distributeur fungeert SNX als schakel tussen een diverse groep leveranciers en klanten. Het bedrijf distribueert meer dan 200.000 producten, variërend van hardware zoals computers, servers en opslag tot hyperscale-infrastructuur en cloudservices zoals cybersecuritysoftware. SNX biedt een kans om mee te groeien met brede IT-uitgaven, zonder te hoeven voorspellen welk product het in de toekomst goed gaat doen.

Booking Holdings

Booking Holdings is de online wereldleider op het gebied van reizen en gerelateerde diensten. De kernactiviteit, het in Nederland gevestigde Booking.com, is de grootste online travel agency (OTA). Het platform biedt meer dan drie miljoen accommodaties aan en faciliteerde vorig jaar meer dan een miljard overnachtingen. Naast accommodaties adverteert Booking ook vliegtickets en verhuurauto’s op het platform.

EQT AB

EQT AB is een alternatieve vermogensbeheerder met €130 miljard aan beheerd vermogen (FPAUM) dat het bedrijf investeert in niet beursgenoteerde ondernemingen en assets (private equity). EQT rekent een beheervergoedingspercentage van 1.4%. Zij verdienen naast een management fee ook een performance fee (carry) indien de investeringen goed renderen. Laaken bezocht afgelopen maand de eerste kapitaalmarktdag in Zweden.