Investment Outlook

Investment outlook first quarter 2025

After two strong years for equities, investors are cautious for 2025—particularly retail investors in the U.S. The AAII sentiment index shows that only 35% expect positive returns in the next six months. Instead of exiting the market, we at Laaken continually seek opportunities across a broad universe of stocks and bonds.

Investment outlook fourth quarter 2024

For the final quarter of 2024 the investment committee focuses on long-term economic growth and market expectations for 2025. This analysis zooms in on three crucial economic regions, followed by an assessment of earnings growth estimates and financial market valuations.

Investment outlook third quarter 2024

This quarterly report briefly discusses economic developments and inflation in the important regions for our portfolios, followed by a more detailed discussion of the positioning within the investment categories of bonds, shares and precious metals. The relative returns compared to the market average are further discussed.

Investment outlook second quarter 2024

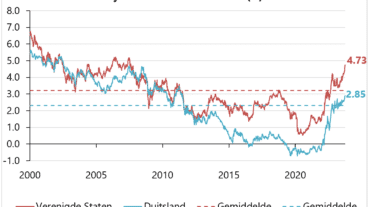

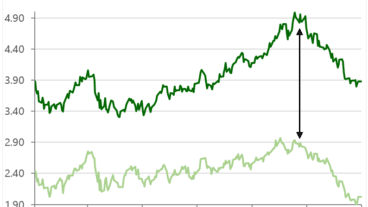

After a strong 2023, stock markets continued to rise in 2024. The MSCI World stock index rose 10% in the first quarter of 2024. Bonds had a slightly negative average return due to a rise in interest rates. Our stock selection lagged slightly behind the market average, but our bond selection outperformed. This quarter we will discuss our view of inflation further and how it translates into our portfolio management.

Investment outlook first quarter 2024