World economy

After three tumultuous quarters, equity markets recovered slightly in the fourth quarter. The MSCI world stock index closed 2022 with a drop of 13% in euro. High inflation in the US and EU persisted at 7% and 10% respectively. Subsequently, the US Fed raised their policy rate from 0.25% at the end of 2021 to 4.5% at the end of 2022. The interest rate rise caused a correction in the stock markets and brought volatility back to the dormant bond market with a sharp plunge.

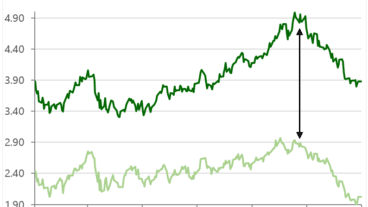

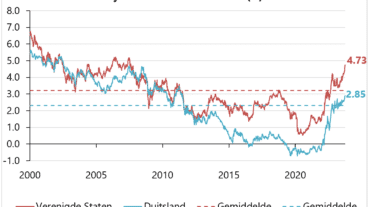

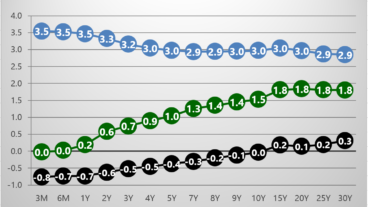

Headlines are full of recession expectations for 2023, prompting investors to withdraw their capital from the stock market. Only 20% of US investors expect the value of the stock market index to increase in the next six months, according to the AAII index. In uncertain times, investors require higher expected returns. The S&P 500 index of large US companies trades at 18x expected earnings over the next 12 months, significantly lower compared to 22x at the end of 2021. 2-year government bonds in Germany and the US now yield 2.4% and 4.2% compared to respectively -0.7% and 0% last year. The biggest interest rate shock for bonds seems to be behind us. After all, a rise from 0% to 4% has a mathematically greater impact on the bond price than another hypothetical step of 4%. The US Fed has indicated that the current interest rate is close to being “sufficiently restrictive” to dampen inflation. The markets expect another 0.25%-0.5% increase in the policy rate in 2023 in the US and 1.5% in Europe. We expect the inflation shock to last longer than the markets currently anticipate and therefore remain cautious on interest rate risk.

Almost all economic forecasts omit the fact that the stock market is only partially dependent on the current economy. For example, the S&P 500, which bottomed during the financial crisis in Q1 2009 even though the economy only recovered in Q3. If an investor had predicted the economy completely correctly and only re-entered in Q3 2009, the S&P 500 would have recovered 25% by then.

Our analysts recently flew to New York where dozens of global corporations held investor conferences including S&P Global. The overarching message from these companies was that they expect lower economic growth in 2023, accompanied by rising costs due to inflation. Cost inflation dampens earnings growth for companies without pricing power. At Laaken, we see pricing power as one of the most important criteria for our stock selection. 88% of the companies in our portfolio can (contractually) pass on inflation and/or mainly serve affluent customers. A frequently asked question is whether consumer spending will decrease as a result of cost inflation, thereby depressing corporate profits. This question was also brought up to the CEO of American Express (in our portfolio). He replied with a new question: “Have you cut your spending recently? Because you are one of my clients.” We expect that affluent consumers will hardly adjust their spending patterns to higher inflation.

We also see positive developments in Asia. Japan recently lifted their Covid restrictions. From January 8, 2023, China will welcome international travelers again after 2.5 years by removing quarantine requirements. We do not invest directly in Chinese companies, but LVMH, Nike and Visa will benefit from this reopening.

We keep focus on the long term. Our strategy of investing in companies with a sustainable competitive advantage at acceptable valuations remains steadfast even in times of market fluctuations. We did not participate in the rollercoaster of loss-making companies that was characterized by the ARKK Innovation ETF: 140% increase in 2020, 67% decrease in 2022 and 40% decrease over three years. We believe that innovation and profitability are not mutually exclusive. We recently spoke with product managers from S&P Global. A month ago, they introduced an ESG functionality that estimates how companies are physically affected by climate change. Another example from our portfolio is Novo Nordisk, which is a pioneer in diabetes medicines. They were the first to introduce a tablet version of GLP-1, a medicine that stimulates insulin release, and are now testing a variant of their molecule for Alzheimer’s. What connects both companies is that they have already built up a dominant, profitable position from which they continue to innovate. They are not dependent on capital markets for funding and trade at acceptable valuations.

Fixed income

With a relatively low interest rate sensitivity, the bond portfolio is able to withstand an interest rate rise with limited losses. The combination of higher interest rates and increased spreads drives significantly higher returns on corporate bonds. We are steadily rolling maturing loans to medium-term loans due to this higher yield, but for the time being maintain a low interest rate sensitivity compared to the benchmark.

Equities

We further reduced cyclical positions. We decreased the position in Alphabet due to sensitivity to a weaker advertising market. Furthermore, we reduced the ASML position. We attended their recent Capital Markets Day in Veldhoven. They remain a market leader in EUV, but the valuation has since risen significantly. Furthermore, the position in LEG was sold. They announced that they will have to take the political climate into account if they want to increase their rents in 2023. They also changed their dividend policy after which the shares no longer meet our return criteria. We initiated a position in Universal Music Group, the largest music label globally. They primarily generate revenues when their music is listened to on streaming platforms such as Spotify and Apple Music. After our discussion with management at their European headquarters in Hilversum, we believe that most consumers will not cancel their €10/month Spotify subscription in a recession.

The gold position has increased as a percentage of the portfolio due to market movements, this higher allocation is maintained.