World Economy

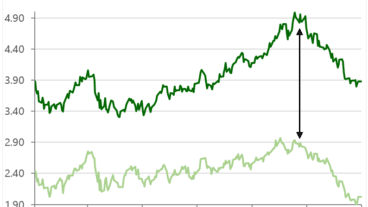

First, the interest rate hike. The US Central Bank (FED) announced beginning of this year it would raise interest rates and took the first 0.25% step. The European Central Bank (ECB) lowered growth expectations and raised inflation expectations, but is still keeping monetary policy loose. However, the market already anticipates a tighter policy in Europe. 2-year risk-free rates in Europe are up 0.61% and 10-year 0.77%, in the US they are up 1.64% and 0.99% respectively. Given that a loan with a ten year maturity loses value by approximately 10% with an interest rate increase of 1%, these are significant movements. The broad-based bond benchmark for our portfolios is therefore also approximately 6% lower since the beginning of the year.

Second, inflation developments, one of the driving forces behind the interest rate hike. Recent inflation statistics remain high and, more significant, inflation expectations are rising. Average market-priced inflation in the US over the next ten years rose slightly to 2.89%. In Europe there was a larger increase and an average of 2.67% is expected. The 5yr-5yr inflation, a good long-term inflation indicator (the average inflation expectation for the five years, five years from now, so 2027 to 2031) has increased for these regions by only 0.13% and 0.28% to 2.39% and 2.24% respectively. These long-term expectations are considerably lower than the recently very high realized inflation values. Much of the current high inflation is due to disrupted supply chains. COVID-Lockdowns in key production areas, transport problems, semiconductor shortages and the war in Ukraine are now causing scarcity of a large number of products and high energy prices, but may normalize in the long run.

Third, stock market movements. Although the MSCI world stock index fell only slightly over the first quarter, underlying movements are very pronounced. In recent years, growth stocks have outperformed value stocks significantly. This year, the rotation went the other way. Energy companies in particular, usually value stocks, have had a decisively good start to the year after many years of below average returns. This sector is up 20% in USD. Excluding energy, the index is down 6% in USD. In particular, the unprofitable growth companies with a lot of expected value in their valuations have had a hard time. The ARK Innovation ETF, a fund praised for performance in 2020 with mainly these types of investments, lost 30% in value in the first quarter. We have always remained cautious towards such companies and these are not in the portfolio. The emphasis on quality companies that can achieve growth means that Laaken holds relatively less value than growth companies in its portfolio.

The negative stock market reaction to Russia’s invasion of Ukraine was initially fierce, but has largely recovered. We have kept equity allocation the same by buying in the correction, but are not increasing it because it is impossible to predict how this crisis will develop. The first attack on a European country in decades is a humanitarian disaster and creates a lot of uncertainty, but has also united the EU. Unfortunately, further escalation is not excluded, as is a European energy crisis or a period of low or negative economic growth with higher inflation.

In conclusion, the adjusted outlook of tighter monetary policy, more near-term inflation and more geopolitical tension, is processed relatively well by the markets. Stocks fell less sharply than bonds because more inflation increases the nominal (real growth plus inflation) growth expectation and that could be beneficial for company revenues. Based on our assessment of the global economy and financial markets, we are positioned as follows:

Bonds & liquidities

The underweight position in bonds was favourable over the first quarter and will be maintained. The portfolios are characterized by short average maturities, which makes the portfolio less sensitive to further interest rate rises than the reference index.

Equities and precious metals

We maintain a slightly overweight position in equities and try not to time the market in the current uncertain environment. The companies in portfolio generally have healthy balance sheets and we believe these investments have sufficient resilience to weather this difficult and unpredictable period. Due to the emphasis in selection on quality, the portfolio has a higher than average valuation and the portfolios have recently declined more than the market average. In recent years, however, the Laaken portfolios have also been structured with an emphasis on companies with pricing power. We believe that many companies in the portfolios are well placed to pass on the current higher inflation to their customers.

The gold position is maintained as inflation protection and insurance against geopolitical risk.