Core Activities: Building the Backbone of the Digital and Industrial Economy

Comfort Systems is a technology-driven engineering and construction leader specializing in building-critical infrastructure. Its operations are centered around:

- Mechanical systems (~75% of revenue): essential for HVAC (Heating, Ventilation, and Air Conditioning)

- Electrical systems (~25%): powering and distributing energy across facilities

This infrastructure is indispensable for data centers, where thousands of servers generate immense heat that must be continuously dissipated. Without effective cooling and reliable power, no data center can operate. FIX’s stable service and maintenance segment (15% of revenue) is poised for further growth as data centers become more complex and mission-critical.

Structural Growth Drivers: Transformative Demand

Demand for FIX’s services has fundamentally shifted. Digital infrastructure expansion now acts as a strong tailwind:

- ~40% of revenue stems from the technology sector.

- The AI revolution is accelerating this trend as hyperscalers and cloud providers massively expand capacity.

In parallel, FIX benefits from America’s industrial reinvestment cycle, driven by strategic reshoring of critical manufacturing. Approximately 23% of its revenue originates from the manufacturing sector.

This momentum is evident in FIX’s record order backlog, which reached $8.1 billion in Q2 2025, equivalent to a full year of revenue, providing exceptional visibility into future earnings.

Sustainable Competitive Advantages: Scale and Innovation

FIX stands out in a fragmented industry through tangible advantages:

- Scale and technical breadth enabling execution of large, complex projects.

- Financial strength to secure bonding for megaprojects, an entry barrier excluding smaller peers.

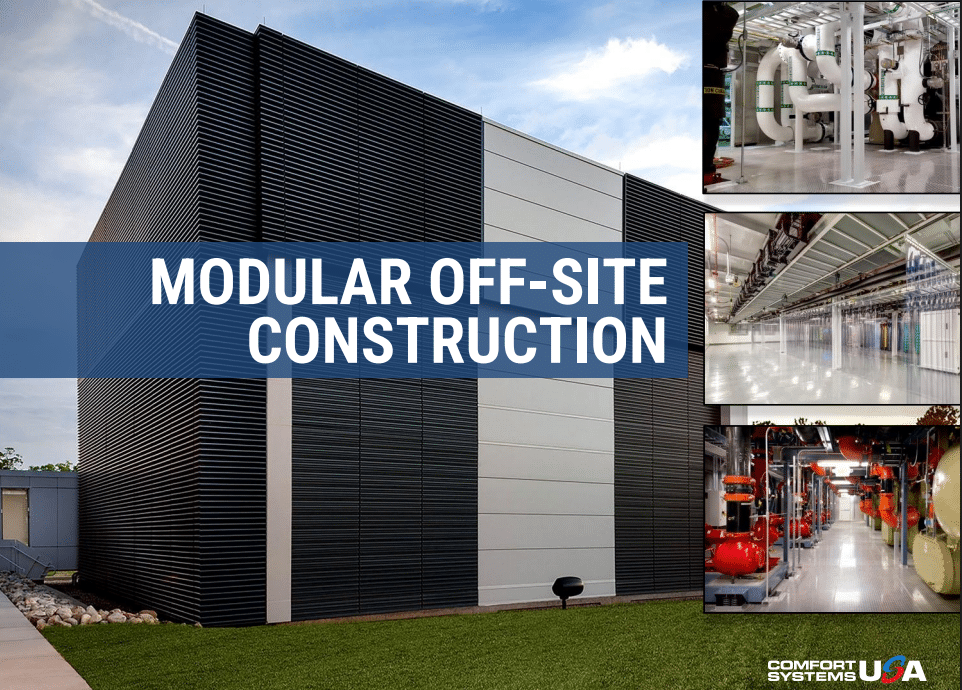

- Leadership in modular construction and prefabrication, improving quality and efficiency while mitigating labor shortages and delays.

This strategic position allows FIX to be highly selective, focusing on complex, high-margin projects where it maintains pricing power.

Management and Capital Allocation: Disciplined Consolidation

Led by CEO Brian E. Lane, FIX has delivered a 37% compound annual total return (CAGR) since 2011—a remarkable track record. The company’s strategy centers on consolidating a fragmented industry via disciplined acquisitions:

- ~75% of free cash flow reinvested in M&A.

- Consistent return on invested capital (ROIC) above 15%, reflecting strong integration capabilities.

Growth is primarily cash-funded, not debt-financed, maintaining a robust balance sheet and flexibility for opportunistic acquisitions.

ESG Profile: Commitment to Sustainability and Safety

- Targeting 35% reduction in Scope 1 & 2 emissions per square meter by 2035.

- Improved Total Recordable Incident Rate (TRIR) to 0.97 in 2024.

- Significant investments in workforce development.

- Governance oversight via a dedicated ESG board committee.

Valuation and Growth Outlook: Conservative Expectations

FIX trades at 30x forward earnings, justified by structurally improved profitability (12% net margin, ROIC >30%). Organic growth consistently exceeds conservative management forecasts, with quarterly earnings averaging 29% above analyst estimates.

Consensus still underestimates the strength of secular trends in AI infrastructure and industrial reinvestment. The valuation remains defensible:

- No net debt

- Superior capital allocation discipline

- Multi-year tailwinds from an unfolding investment supercycle

This mirrors our earlier thesis on Broadcom: both are industry leaders with proven management, a track record of value-accretive acquisitions, and valuations that may appear high but are underpinned by conservative earnings assumptions.

Risks and Considerations

Key risks include:

- A potential reversal of the reshoring trend or delays in data center expansion.

- Cyclical exposure, though FIX has generated positive free cash flow for 26 consecutive years.

- Skilled labor shortages could pressure growth and margins.

- Succession planning for the experienced leadership team remains a focus area.