Investment Outlook

Investment outlook second quarter 2024

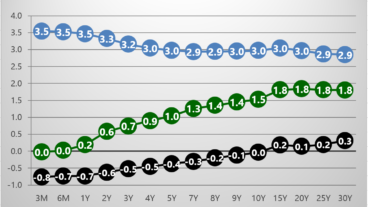

After a strong 2023, stock markets continued to rise in 2024. The MSCI World stock index rose 10% in the first quarter of 2024. Bonds had a slightly negative average return due to a rise in interest rates. Our stock selection lagged slightly behind the market average, but our bond selection outperformed. This quarter we will discuss our view of inflation further and how it translates into our portfolio management.

Investment outlook first quarter 2024

Investment outlook fourth quarter 2023

Investment outlook third quarter 2023

Investment outlook second quarter 2023

Investment outlook first quarter 2023

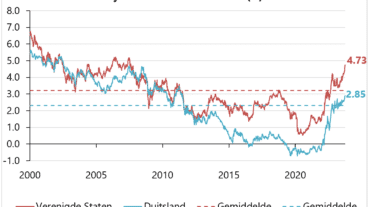

After three tumultuous quarters, equity markets recovered slightly in the fourth quarter. The MSCI world stock index closed 2022 with a drop of 13% in euro. High inflation in the US and EU persisted at 7% and 10% respectively. Subsequently, the US Fed raised their policy rate from 0.25% at the end of 2021 to 4.5% at the end of 2022. The interest rate rise caused a correction in the stock markets and brought volatility back to the dormant bond market with a sharp plunge.

Outlook fourth quarter 2022

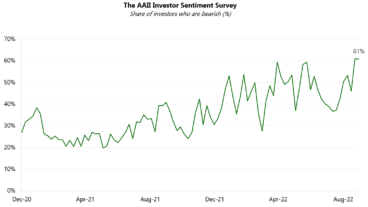

After the attack on Europe’s energy infrastructure, Russian mobilization, sharp rises in consumer price indices and unprecedented interest rate hikes by the US and European central banks, the financial markets are in limbo.