Bewezen vermogensbeheer

Voor particulieren, families, ondernemers en stichtingen

Laaken brengt vermogensbeheer terug tot de kern: het samenstellen van optimale beleggingsportefeuilles om zo een beter rendement dan de markt te behalen. Benieuwd hoe u kunt profiteren van onze bewezen strategie? Vraag vrijblijvend onze brochure aan.

Welke dienstverlening past bij u?

Vermogensbeheer

Vanaf € 1.000.000- Persoonlijk advies

- Maatwerk portefeuille

- Periodieke (advies)gesprekken

- Jaarlijkse kosten = 0,50% - 1,36%

- Dagelijks verhandelbaarheid

- Depotbank naar keuze

Beleggingsfondsen

Vanaf € 250.000- Zelf kiezen welk fonds

- Modelportefeuille

- Contact op uw initiatief

- Jaarlijkse kosten = 1,11%

- Maandelijkse verhandelbaarheid

- Beleggen via inschrijving

Over Laaken

Een professionele vermogensbeheerder moet actief streven naar een beter rendement dan de markt. Veruit de meeste vermogensbeheerders lukt dit niet en kiezen daarom steeds vaker voor passieve beleggingen. Zo volgen ze de markt; maar verdienen de beheerkosten niet terug. Haalt u zo het maximale uit uw vermogen? Wij zijn ervan overtuigd dat er een betere manier is.

Uitstekende rendementen sinds 2007

Bij Laaken behalen we een significant beter rendement dan de markt. Dit resultaat plaatst ons ver voor ten opzichte van veel andere vermogensbeheerders en banken in Nederland.

Het Defensive risicoprofiel belegt ~35% in aandelen en ~65% in obligaties. Deze modelportefeuille vormt de basis van zowel het Laaken Defensive Fund alsmede het individueel beheer met een defensief risicoprofiel. De behaalde beleggingsresultaten kunnen (licht) afwijken van de modelportefeuilles.

Het cumulatief bruto rendement (vóór kosten) van deze modelportefeuille sinds oprichting in 2007 was 155.5%. In dezelfde periode maakte de markt een cumulatief rendement van 100.6%. Hiermee levert Laaken een bruto outperformance 55.0%. Het gemiddelde bruto rendement per jaar was 5.6% versus de benchmark van 4.1%.

Het Balanced risicoprofiel belegt ~60% in aandelen en ~40% in obligaties. Deze modelportefeuille vormt de basis van zowel het Laaken Balanced Fund alsmede het individueel beheer met een balanced risicoprofiel. De behaalde beleggingsresultaten kunnen (licht) afwijken van de modelportefeuilles.

Het cumulatief bruto rendement (vóór kosten) van deze modelportefeuille sinds oprichting in 2007 was 280.3%. In dezelfde periode maakte de markt een cumulatief rendement van 159.5%. Hiermee levert Laaken een bruto outperformance 120.8%. Het gemiddelde bruto rendement per jaar was 8.1% versus de benchmark van 5.7%.

Het Offensive risicoprofiel belegt ~90% in aandelen en ~10% in obligaties. Deze modelportefeuille vormt de basis van zowel het Laaken Offensive Fund alsmede het individueel beheer met een offensief risicoprofiel. De behaalde beleggingsresultaten kunnen (licht) afwijken van de modelportefeuilles.

Het cumulatief bruto rendement (vóór kosten) van deze modelportefeuille sinds oprichting in 2007 was 376.2%. In dezelfde periode maakte de markt een cumulatief rendement van 247.2%. Hiermee levert Laaken een bruto outperformance 129.0%. Het gemiddelde bruto rendement per jaar was 9.5% versus de benchmark van 7.5%.

Risico's

Beleggen brengt risico’s met zich mee zoals marktrisico, koersrisico, kredietrisico, renterisico en valutarisico. U kunt uw inleg verliezen. De waarde van uw beleggingen is mede afhankelijk van de ontwikkelingen op de financiële markten. In het verleden behaalde resultaten bieden geen garantie voor de toekomst.

Finner waardeert Laaken met 5 sterren

Finner waardeert Laaken met 5 sterren

Waarom beleggen bij Laaken?

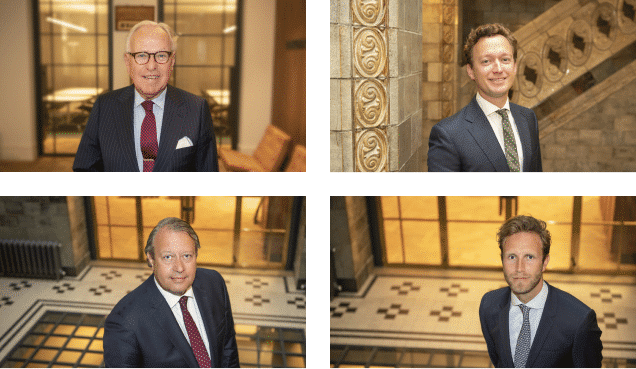

Laaken heeft sinds oprichting een van de beste trackrecords van Nederlandse beheerders. De actieve afwijking van het marktgemiddelde door ons team van ervaren beleggers heeft tot zeer sterke resultaten geleid.

De partners beleggen hetzelfde als onze cliënten. Voorts is Laaken geen bank; als onafhankelijke beheerder verdienen wij niet aan transacties en producten in de portefeuilles. Daarnaast is beheren van vermogen onze enige activiteit.

De portefeuilles kunnen op ieder moment liquide gemaakt worden. Wij committeren uw vermogen niet in beleggingen waar u langere tijd aan vast zit.

Wat kan Laaken voor u betekenen?

Bent u benieuwd wat Laaken voor u kan betekenen? Neem contact met ons op of vraag de brochure aan.

Investment Outlook & Thesis

Beleggingsvooruitzichten tweede kwartaal 2024

Na een sterk 2023, stegen de aandelenmarkten verder door in 2024. De MSCI World aandelenindex steeg met 10.9% in het eerste kwartaal van 2024. Obligaties hadden gemiddeld een licht negatief rendement vanwege rentestijging. De aandelenselectie van Laaken bleef licht achter bij het marktgemiddelde, maar de obligatieselectie presteerde beter. Wij gaan dit kwartaal verder in op inflatie en de vertaling naar ons beheer.

Lees de volledige outlook

EQT AB

EQT AB is een alternatieve vermogensbeheerder met €130 miljard aan beheerd vermogen (FPAUM) dat het bedrijf investeert in niet beursgenoteerde ondernemingen en assets (private equity). EQT rekent een beheervergoedingspercentage van 1.4%. Zij verdienen naast een management fee ook een performance fee (carry) indien de investeringen goed renderen. Laaken bezocht afgelopen maand de eerste kapitaalmarktdag in Zweden.

Lees de volledige thesis“Money will not manage itself”

Walter Bagehot 1827 - 1877

Wat kan Laaken voor u betekenen?

Bent u benieuwd wat Laaken voor u kan betekenen? Neem contact met ons op of vraag de brochure aan.